Product updates

Dynamic withholding tax rates

New feature June 15, 2022

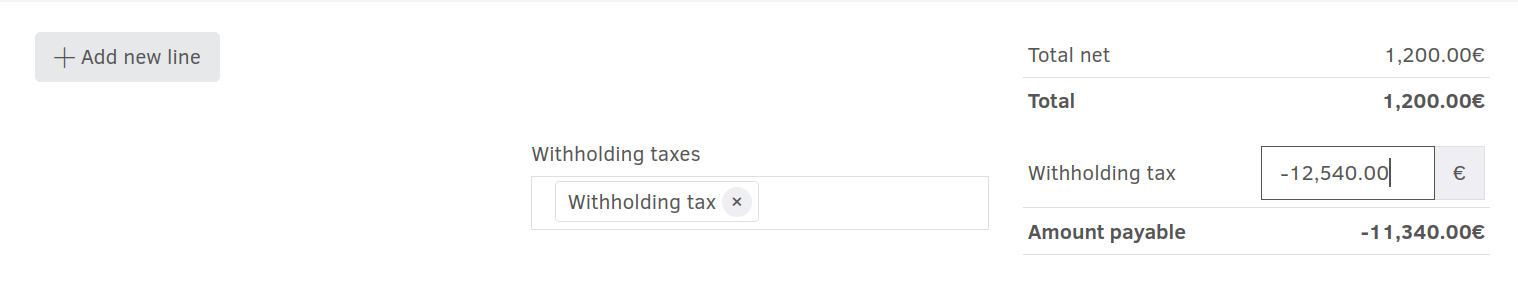

Starting today, you can create withholding taxes whose rates are dynamic. Whenever dynamic withholding taxes are applied on invoices, you will be prompted to set the tax amount yourself.

This is especially useful for taxes that cannot be calculated as a percentage of the invoice total. Such cases have been historically supported via the “Fixed amount” taxes feature. However, one should practically create a new tax for each tax amount, even if the tax was actually the same. Apart from the additional management effort, this process also yielded inaccurate results in the tax reports. If your business involves such taxes, using the all-new dynamic withholding tax rates can really fasten your workflow and solve the above problems.