Product updates

[Greek version] Added support fot the "VAT Exempted 195" option

New feature December 23, 2024

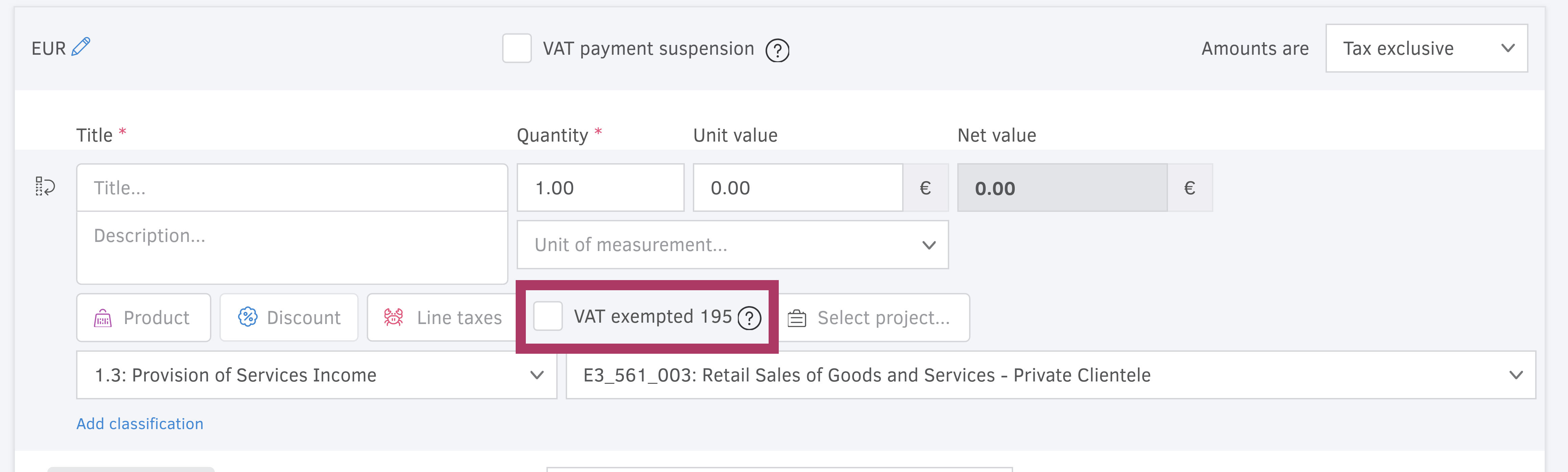

A new feature tailored for our users in Greece has been added to Elorus. The “VAT exempted 195” option is now available for invoice lines, corresponding to the myDATA “notVAT195” field. This aligns with the myDATA framework and ensures that VAT amounts for these lines are excluded from the periodic VAT return declaration (income).

To activate this functionality, simply navigate to the application settings page and enable the option: “Let me set the ‘VAT exempted 195’ option on invoice lines."

Once enabled, users can effortlessly denote specific invoice lines with this classification, ensuring compliance with Greek tax regulations.