Product updates

Subtotals in withholding taxes

New feature December 16, 2022

Our latest feature might not be of interest to everyone, but it’s cool anyway :)

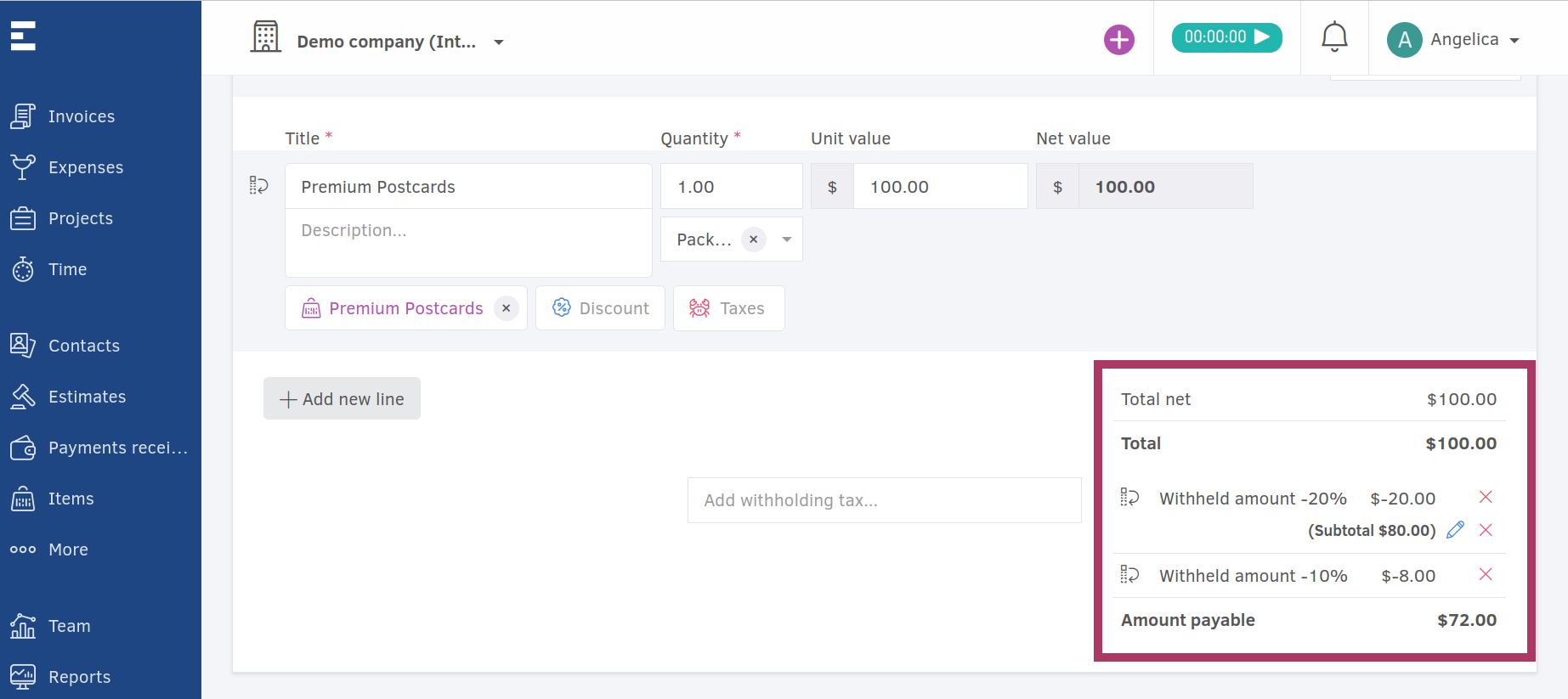

We’ve implemented the ability to insert subtotals on any withholding tax, based on which subsequent taxes will be calculated.

Consider the simple scenario of a 100$ invoice, on which both a 20% and a 10% withholding tax must be applied. The amount of the first tax is 20$, the second is 10$, therefore the total amount payable is 70$ (100$ - 20$ - 10$).

But what if we need the second tax to be calculated after the first tax has been applied? In that case, the amount of the second tax should be (100$ - 20$) * 10% = 8$, resulting in a total payable amount of 72$.

The above requirement is rather uncommon, but still an absolute necessity for businesses operating in countries with complex taxation systems.