Product updates

Withholding taxes: new features

New feature November 25, 2021

As you may already know, Elorus has always been able to support the concept of withholding taxes / retention taxes (i.e. taxes that reduce an invoice’s payable amount, rather than the actual total amount). With this release, we’ve updated our tax calculation system to cater for the following scenarios:

Fixed amount withholding taxes

You may now define withholding taxes that always subtract a fixed amount from the invoice, regardless the invoice net.

Apply withholding taxes on the invoice lines

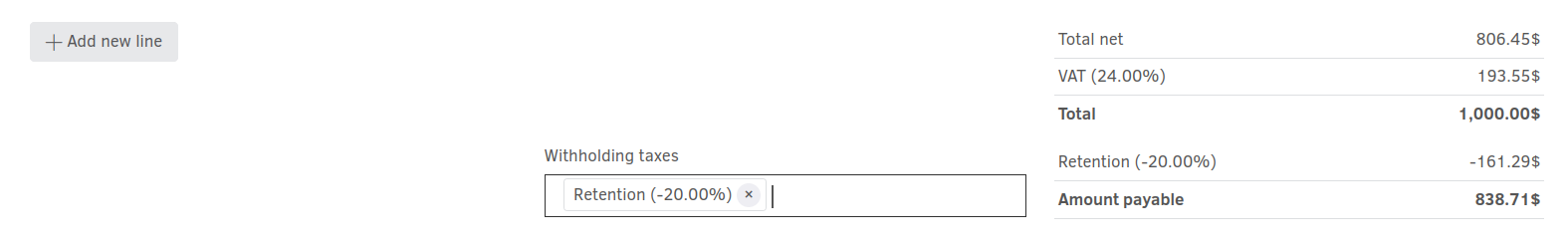

Withholding taxes are typically calculated as a percentage over the invoice’s total net amount. As a result, Elorus will apply the tax directly on the invoice (see image below).

However, in some cases the retention should be selectively applied on a subtotal. To facilitate this, we’ve added a new setting in the tax configuration page. When activated, the new setting will enable the tax to be applied on the invoice lines rather than the invoice total.

Taxes being used for information purposes

We’ve added support for a special form of withholding taxes, being used only for information purposes. For example, if a withholding tax is already included in the price, you may use this feature to denote that the tax should not affect the amount payable. Taxes being used for information purposes appear on a special table on the invoice and are also included in your tax reports.